According to a June 2021 report by the International Dairy Foods Association (IDFA), the Texas dairy industry — including production and wholesale and retail sales — accounts for a total economic impact of $50.3 billion in Texas, or nearly 3 percent of the gross state product. The IDFA estimates the Texas dairy industry generates $12.7 billion in total wages for 253,000 direct and indirect jobs.

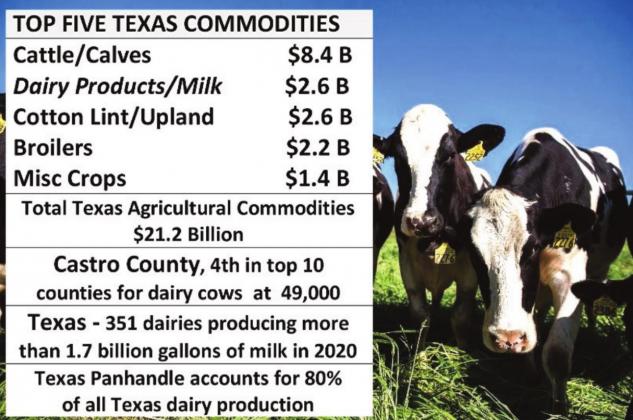

According to the last report, Castro County remains in the top 10 counties at fourth in the state with dairy cows, with an estimated 49,000 cows, behind Erath, 59,000, Hemphill, 57,000, and Potter, 50,000. Other top 10 counties are Deaf Smith, Moore, Lamb, Hopkins Comanche and Bailey. In 2011, Castro County was the lead milk producing Texas county.

Recipients of Dairy Program Subsidies from farms in Castro County totaled $3,758,000 from 1995-2020, with the highest at $383,729 at a single dairy.

The IDFA report tallies Texas exports at $486 million worth of dairy products each year, and it is among the top five U.S. states in dairy exports. Also, the top state in total exports, Texas sends about 37 percent of its agricultural exports to Mexico, our largest international trading partner for such products.

Fifty years ago, Texas dairies had an estimated 355,000 dairy cows. By 2020, that number had increased to 595,000, a gain of 67.6 percent, with only four states - California, Wisconsin, Idaho and New York - showing more.

Darren Turley, executive director of the Texas Association of Dairymen, says, “The Texas dairy industry continues to see growth, and we are on track to move up to be the fourth-largest dairy state in the nation, surpassing New York.”

U.S. Department of Agriculture (USDA) data estimate cash receipts for milk sales from Texas dairy farms in 2019 were $2.6 billion, the second highest among the state’s agricultural commodities and 12.5 percent of total receipts.

Despite the state’s growth in dairy production and sales, the actual number of Texas dairy farms declined in recent years. Texas dairy producers today amount to about 12 percent of the total from 45 years ago. Yet production has more than quintupled. In 1975, Texas had 2,890 producers churning out about 3 billion pounds of milk. Today, Texas has just 351 dairies but produced more than 14.8 billion pounds, or more than 1.7 billion gallons, of milk in 2020.

Texas dairy producers today amount to about 12 percent of the total from 45 years ago. Yet production has more than quintupled.

“Texas continues to lose farms, but our farms are both growing in size and producing more milk,” says Turley. Much of this growth is happening in the Texas Panhandle, which now accounts for 80 percent of all Texas dairy production. In the USDA’s report 2020 Texas Agricultural Statistics (PDF), which lists milk-producing cows by county, seven of the 10 counties with the largest dairy cow populations are in the Panhandle area.

Texas dairy farmers have weathered some tough times in recent years. In December 2015, a fierce winter storm named Goliath swept into the Texas Plains and Panhandle, devastating dairy farmers who lost tens of thousands of cows and had to suspend production.

The February 2021 freeze was brutal as well, but this time the state’s dairy farmers were better prepared, Turley says. “Texas dairy producers learned a lot from the Goliath storm event of 2015 to help them prepare for this year’s storm event. Farms now have generators to continue operations and have changed how they manage cows in order to keep them warm in the coldest of times.”

Turley says the February freeze, however, did affect the processing sector of the dairy industry. “Even though farmers continued to milk cows through the storm, processing plants were shut down due to lack of electricity and natural gas, frozen pipes or icy roads. The weeklong shutdown filled available milk haulers, and millions of gallons of milk had to be disposed of because no processing facility could accept it. Not only was this milk that did not make it to market, but it also was a loss in income for dairy farmers.”

A December 2020 study published in the Journal of Integrative Agriculture found that the pandemic also affected the U.S. dairy industry. Farm gate milk prices — the prices farmers receive if milk is sold on their farmland — decreased, and the industry experienced “disruption and difficulties of moving milk within the supply chains, worker shortages, increased production costs, and lack of operating capital.” The study further mentioned the shutdown of many U.S. dairy processors due to the closing of schools, restaurants and hotels — all of which are major dairy customers.

Turley says filling industry jobs remains a challenge. “The COVID-19 pandemic initially created some milk oversupply issues when it shut down the food service industry, a significant buyer of dairy products. It also has increased the struggle with a very tight labor market in our rural areas. Our markets are stabilizing, but farm labor is still short.”

Federal COVID-19 relief legislation provided funding for the U.S. industry through the Dairy Margin Coverage Program ($473 million), which provides necessary cash flow assistance to small and mid-sized dairies, and the Dairy Donation Program ($400 million), which pays milk processors for the full value of milk and other dairy products donated to food assistance programs.

The dairy industry has experienced dramatic changes over the years. Today’s dairy farmers still tend to be family farmers, but with larger, streamlined operations, and the U.S. dairy industry continues to consolidate and modernize. Texas dairy farmers have followed suit by incorporating newer technologies into their operations.

Robotic milking stalls also are gaining traction in Texas. Two robotic dairies now operate in Snyder and Windthorst in West Texas and the Wichita Falls MSA, respectively.