President Donald Trump reversed course and signed the bill that funds the government and provides a third round of coronavirus relief payments.

The coronavirus relief for farmers includes a billion dollars to compensate for depopulated poultry and livestock losses for up to 80% of their value. Row crop farmers will be eligible for new 20-dollaran-acre payments for the same qualifying crops as the last round of the Coronavirus Food Assistance Program (CFAP-2).

American Farm Bureau estimates the new aid will amount to nearly 1.8 billion dollars for corn, 1.7 billion dollars for soybeans, and about 886 million dollars for wheat.

The newly signed package allows USDA to extend the term of marketing loans by three months, allows aid for biofuels producers affected by market losses, and extends the Paycheck Protection Program along with clarification that PPP funding can be used for COVID mitigation costs and expenses paid with PPP money are tax deductible.

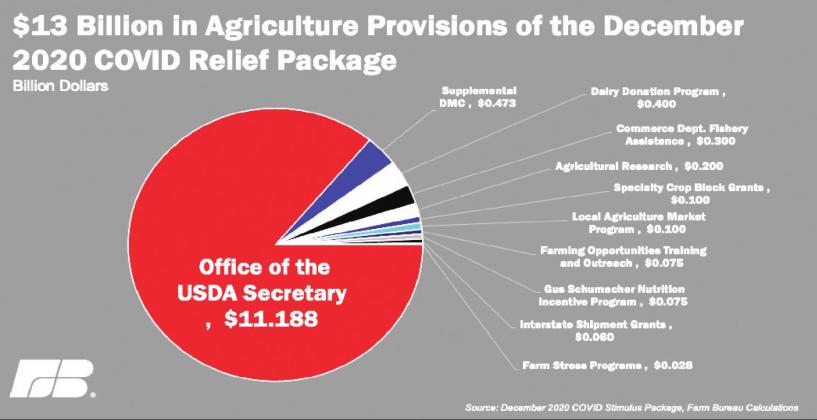

Nearly a billion dollars is earmarked for a dairy donation program and supplemental Dairy Margin Coverage payments. There is also 22 million dollars included to support dairy business innovation initiatives.

The Supplemental Nutrition Assistance or SNAP program benefits were also increased 15%.

The price tag is 1.4 trillion dollars for the fiscal year 2021 including 900 billion dollars for coronavirus relief. Trump wanted larger individual stimulus checks and elimination of what he called wasteful spending when criticizing the bill last week, though the high-dollar foreign aid section of the bill was a part of the White House budget submitted by his administration.

The bill provides approximately $11.2 billion of direct financial assistance to commodity producers. Producers of 2020 price trigger crops and flat-rate crops are eligible to receive a payment of $20 per eligible acre of the crop. Price trigger commodities, as defined in the second Coronavirus Food Assistance Program, are major commodities that meet a minimum 5% price decline over a specified period. These crops include barley, corn, sorghum, soybeans, sunflowers, upland cotton and all classes of wheat. Across these seven crops alone, 240 million acres were planted, representing $4.8 billion in COVID-19 stimulus.

The bill requires that a portion of the appropriated money to be used to make payments to domestic users of upland cotton and extra long staple cotton between March 1, 2020, and December 31, 2020.

Moreover, one of the consequences of COVID-19 precautions and stay-at-home orders was a significant decrease in fuel consumption, and along with it was a slash to biofuel demand. Since the beginning of the year, and through mid-December, the cumulative decline in ethanol production is nearly 2 billion gallons.

For offshore aquaculture producers, there is an additional $300 million in Fisheries Disaster Assistance available until September 30, 2021, for the Sec. 12005 CARES Act assistance program. In the CARES Act, an initial $300 million in direct assistance was provided to fisheries that were negatively impacted by COVID-19, including commercial fishing businesses, charter/for-hire fishing businesses, qualified aquaculture operations, processors and other fisheryrelated businesses, e.g., The Ins and Outs of Direct Assistance for Fisheries.

For timber harvesting and timber hauling businesses, $200 million is allocated for relief to those that experienced a loss of at least 10% of gross revenue between Jan. 1, 2020, through Dec. 1, 2020, compared to the gross revenue earned in the same period in 2019.

Poultry, in particular, was left out of the CARES Act, largely due to the structure of the industry and how the relationship between the farmer and integrator historically has operated. Under the CARES Act, to be eligible for assistance, the farmer had to directly own the commodity.

This worked well for MOST cattle and hog producers, but not for broiler farmers. Typically, a broiler farmer raises and cares for the birds, but does not directly own the birds; the integrator maintains ownership of the animals. The new bill addresses losses faced by many in the poultry industry (and other livestock sectors as well) by providing $1 billion for contract growers of livestock and poultry to cover up to 80% of losses.

The livestock supply chain was significantly disrupted, especially at processing facilities, where labor shortages and worker protection measures slowed throughput and even caused some facilities to shut down. As a result, some producers were forced into the heart-wrenching position of having to euthanize their animals. This bill directs the Agriculture Secretary to make payments to producers for losses incurred due to the depopulation of livestock and poultry due to insufficient processing access. These payments will be up to 80% of the fair market value of the depopulated animals, and for the costs of depopulation.

The bill ensures that livestock producers are paid for their animals by requiring dealer trusts. In the current system, dealers frequently buy and resell livestock, often grouping them to meet the volume and type needs of their customers. Dealers are allowed to take possession of livestock and pay for them later, and dealers do not maintain a trust account to guarantee payment.

This bill included a oneyear authorization to livestock mandatory reporting, extending the law that requires buyers and sellers of meat and livestock to report the price and volume of certain commodities. The bill also aims to assist meat and poultry processing facilities in making improvements to allow for interstate shipment. This bill also includes additional inventory-based direct payments for cattle producers based on the difference between the CARES Act inventory payment rate, the Commodity Credit Corporation payment rate and the CFAP 2 payment rate multiplied by a percentage factor.

The bill would provide necessary cash flow assistance to small and midsized dairies by establishing supplemental dairy margin coverage based on 75% of the difference between recent actual production (based on 2019 marketings) and the established production history currently used by DMC. Program payments under this supplemental program would be based on the additional 2019 production and the elected DMC coverage level.

Following up on USDA’s Farmers to Families Food Box program, the bill includes two donation-style programs. The first is a dairy donation program that will pay milk processors the full value of milk used to produce and donate dairy products into food assistance channels. The $400 million dairy donation program is also retroactive, meaning milk processors may be eligible to receive financial payments for milk previously processed and donated during 2020.

In addition to the dairy-only donation program, the bill would provide $1.5 billion for the Agriculture Secretary to purchase food and agricultural products and distribute these products through nonprofit organizations.