Paycheck Protection Program (PPP) funds are part of a federal program created through the CARES Act to help small businesses stay afloat and keep their workforce employed during the devastating COVID-19 pandemic.

A variety of small businesses qualify for these important funds, such as florists and hair salons, restaurants and cafes, family-owned contractors, and more. Many of these businesses are ingrained into local neighborhoods and towns, often giving back to their communities and fostering a positive culture.

Texas Appleseed began to explore potential abuse of this funding, specifically as it relates to an industry with a history of trapping Texans into a cycle of debt — payday and auto title loan businesses.

The three-party model under which Texas payday and auto title loan businesses operate allows them to evade state interest and fee caps that typically apply to consumer loans, resulting in uncapped Annual Percentage Rates (APRs) that are among the highest in the country — with rates reaching 500% and higher.

Top Findings:

-Texas payday and auto title loan businesses received over $45 million in pandemic relief while continuing predatory practices by offering loans averaging 200% to 500% APR.

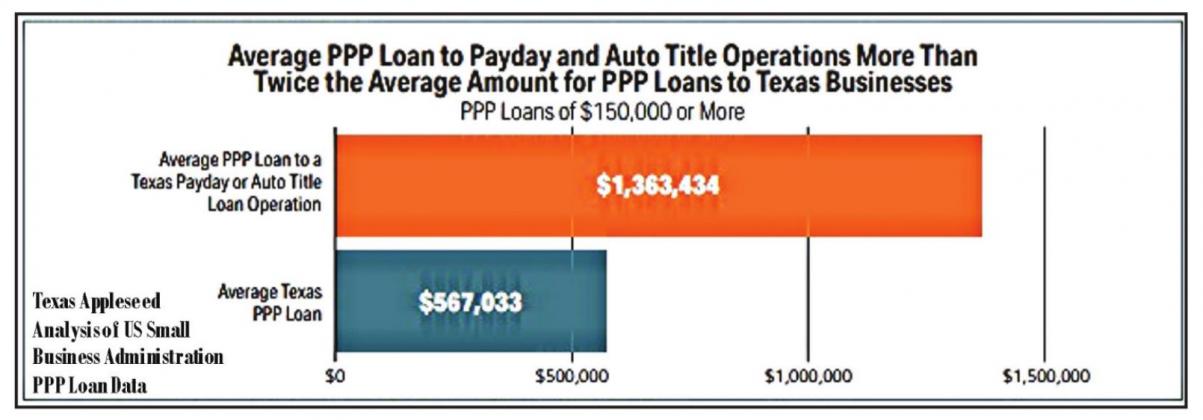

-Payday and auto title businesses operating in Texas received an average forgivable loan amount of $1.363 million — more than twice the average loan amount for all Texas businesses.

-One large national auto title loan operator with Texas subsidiaries received a loan from the Federal Reserve’s Main Street Lending Program at 3.15% interest — a loan intended to support small and mid-sized businesses. In turn, this auto title loan business offers loans to Texans at over 350% APR.

-Texans most harmed by the pandemic are also the most targeted by payday and auto title loans operations.

Small businesses across the state struggled to get access to the Paycheck Protection Program (PPP) funds. Black- and Latino-owned businesses were at a particular disadvantage and many could not access the program at all.

Meanwhile, payday and auto title loan operations accessed $20.452 million in subsidies through PPP loans, with an average forgivable loan amount of $1.363 million, more than twice the average loan amount for all Texas businesses.

In addition to the PPP loans, one large national auto title loan operator used its Texas subsidiary, Wellshire Financial Services LLC, which does business as LoanStar Title Loans, to access the Main Street Lending Program, funded through the Federal Reserve, at 3.15% interest. The loan, intended to support small and mid-sized businesses, has a five-year term and includes no principal payments for two years and no interest payments for one year. Yet, this same business makes auto title loans to Texans at over 350% APR.

Without needed reforms, payday and auto title loans will continue to harm Texans struggling to recover from the pandemic. Adopting policies to rein in the financial harms caused by these uncapped loans will enhance the economic recovery of financially vulnerable Texans and communities. Payday and auto title loan operations should not receive taxpayer-funded subsidies — and the federal government should take action to address this unconscionable use of public funds. Leaders should also focus on supporting key policies that have proven successful in cities across Texas and in other states.